Stout Restricted Stock Study & DLOM Calculator

SUBSCRIBER SEARCH THE FULL PLATFORM >> | USE DLOM CALCULATOR >>

GUEST (NON-SUBSCRIBER) SEARCH >>

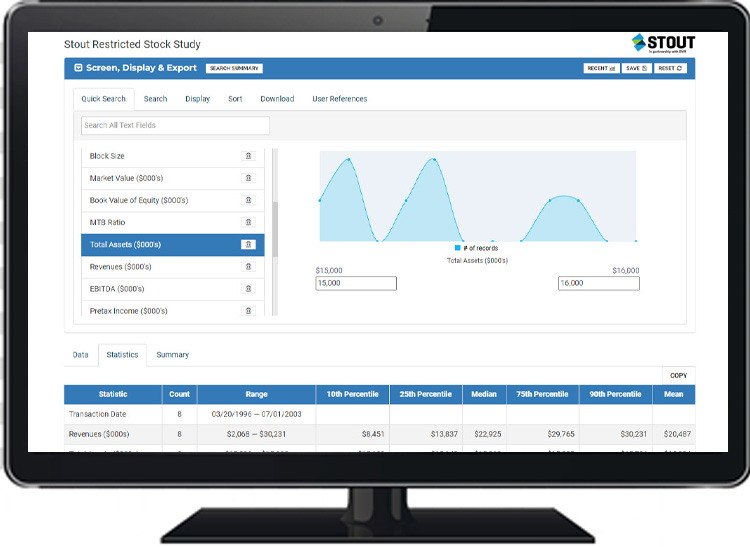

The Stout Restricted Stock StudyTM, updated quarterly, is a thoroughly vetted, restricted stock sourced discount for lack of marketability (DLOM) database that provides empirical support to quantify marketability discounts used in the business valuation, venture capital, and merger and acquisition (M&A) professions. Take advantage of 770+ rigorously screened transactions with up to 60 data fields.

The Stout DLOM CalculatorTM, included with the study, is a robust tool that allows you to quickly implement the Stout methodology and determine a DLOM that is driven by the financial characteristics of the user’s subject company, as well as the volatility of the market as of the user’s valuation date.

Please note: The Stout Restricted Stock Study works with the VPS DLOM Toolkit. Learn more about the Toolkit

The most current empirical data to determine a discount for lack of marketability using restricted stock.

- New! Set up customized deal alerts

- New! Updated user interface that streamlines your workflow

- Rely on firsthand, current empirical data – updated quarterly and rigorously screened, each restricted stock transaction includes up to 60 data fields with verifiable details

- Present your DLOM conclusions with confidence – this powerful tool automatically calculates summary statistics for a number of fields to aid in the analysis of the data

- Save time in deriving your DLOM with the Stout DLOM Calculator – use the tool to:

- Make comparisons between subject companies and issuers of restricted stock included in the Study

- Automate quintile sorting, comparisons and calculations and make market volatility adjustments based on the valuation date

- Adjust the relevant financial statistics for inflation for enhanced comparability with a subject company

Powered by

Copyright © 2021 Sagient Research Systems, Inc. All Rights Reserved. The information presented in this product has been obtained with the greatest of care from sources believed to be reliable, but is not guaranteed to be complete, accurate or timely. Business Valuation Resources, LLC, and Sagient Research Systems, Inc. expressly disclaim any liability, including incidental or consequential damages, arising from the use of this product or any errors or omissions that may be contained in it. No part of this product may be reproduced or used in any other form or by any other means—graphic, electronic, or mechanical, including photocopying, recording, taping, or information storage and retrieval systems—without prior, written permission from Sagient Research Systems, Inc. To obtain permission, please write to: Sagient Research Systems, Inc., 3655 Nobel Drive, Suite 600, San Diego, CA 92122. Your request should specify the data or other information you wish to use and the manner in which you wish to use it. In addition, you will need to include copies of any charts, tables, and/or figures that you have created based on that information. sagientresearch.com